tax shelter meaning in real estate

These are cash losses. It is a legal way for individuals to stash their money and avoid getting it taxed.

Keys To Getting A Condo Mortgage Tips Home Mortgage How To Apply

A tax shelter is a method used by businesses and individuals to reduce their tax liabilities.

:max_bytes(150000):strip_icc()/aerial-view-of-house-roofs-in-suburban-neighborhood-565976173-5b185a148e1b6e0036d465ef.jpg)

. Shelters range from employer-sponsored 401 k programs to overseas bank accounts. Definition of Abusive tax shelter. Your money grows tax-deferred meaning that it can accrue interest and earnings that are not.

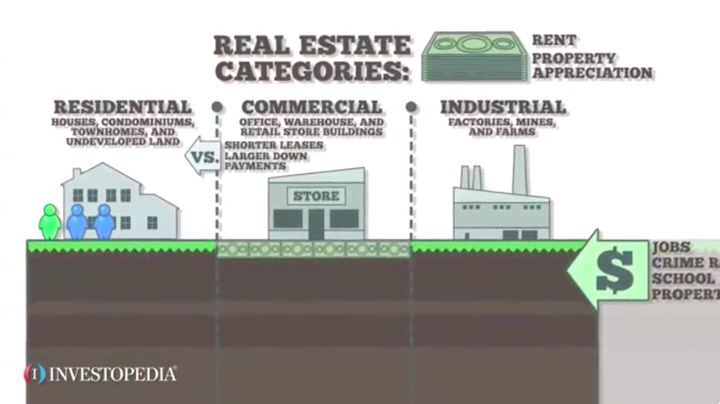

Traditional tax shelters have included investments in real estate oil and gas equipment leasing and cattle feeding and breeding programs. When you contribute to a 401k or a deductible traditional IRA your taxable income is reduced by the amount of your contribution. Tax shelters are ways individuals and corporations reduce their tax liability.

Tax shelter real estate definition Wednesday May 11 2022 Edit. A tax shelter is entirely different from a tax haven because the latter exists outside the country and its legality. 448a3 prohibition defines tax shelter at Sec.

A tax shelter is a means of minimizing tax liability. The IRS allows some tax shelters but. A tax shelter is any method of reducing the taxes you owe legally.

There are many different types and ways to do this but investment is most common. A tax shelter is an investment that generates either tax-deferred or tax-exempt income. The 1031 exchange isnt so much a tax shelter as much as its a process to help defer taxes on capital gains by relinquishing one commercial real estate property into a replacement real estate property of equal or greater value.

Traditional tax shelters have included investments in real estate oil and gas equipment leasing and cattle feeding and breeding programs. The most widely used tax shelter in the US is the 401k. 461i3 provides that the term tax shelter.

A tax shelter is used to lower the amount owed in taxes in a legal manner as defined by the IRS and the tax code. Tax shelters allow investors to reap some. Popular tax shelters include real estate projects and gas and oil drilling ventures.

While the subsidiary will have to pay tax on 2 the tax is payable to the tax authority of British Virgin Islands. In other words it is a type of legal strategy with the help of which an individual can lower their taxable income and hence reduce his or her tax-related liabilities. An investment that produces relatively large current deductions that can be used to offset other taxable income.

Tax shelters can be both legal illegal. Other tax shelters include mutual funds municipal bonds. The most common tax shelter is through such retirement accounts as a 401 k 401 b Roth IRA or a Roth 401 k.

Someone who thinks a feature of the tax code giving. 25 to file your taxes. A tax shelter is a financial vehicle that an individual can use to help them lower their tax obligation and thus keep more of their money.

It can be understood as a financial vehicle or legal strategy or any method applied. There is a penalty of 1 of the total amount invested for the failure to register a tax shelter. To be a tax shelter the investment has to lose money.

The phrase tax shelter is often used as a pejorative term but a tax shelter can be a legal way to reduce tax liabilities. Risk Free Pass Guarantee. Definition of Tax Shelter.

When it comes to rentals it is easy to lose money especially if the rental income does not cover the mortgage you have several repair bills among other things. A tax shelter takes advantage of various aspects of the tax code. Tax shelters work by reducing your taxable income thereby reducing your taxes.

250 Sample Real Estate Exam Questions. Tax Shelter Law and Legal Definition. Or a tax shelter can take advantage of incentive tax deals or of the interest exemption.

Since the British Virgin Islands has a corporate tax rate of 0 no taxes are payable. A tax shelter is more or less like a financial vehicle through which taxpayers can safeguard their money. Updated for 2020 Regulations.

If you carry a mortgage on your rental property you can deduct mortgage interest paid come tax time. A tax shelter is advantageous by the taxpayers in high tax brackets so they can take losses from it to reduce their taxable income. 90-Day Access to Our Testing Materials.

Speaking of real estate acquisitions. A tax shelter is a vehicle to reduce current tax liability by offsetting income from one source with losses from another source. A number of real estate tax shelter exist.

Best Value on the Market. A tax-deferred retirement account is also a tax shelter though not a permanent one. For example it may generate tax-deductible losses via the use of depreciation or interest expenses.

This allows Import Co. A tax shelter is defined differently under various Code sections with one of the broadest definitions used in this case. There wont always be significant real estate investment tax shelter benefits when you are flipping a house because odds are you sell the property within a year of purchasing but every little bit helps.

CrowdStreet - 185 Average IRR from Real Estate Accredited Investors Only. The failure to report a tax shelter identification number has a penalty of. To report taxable income of 0 because it was purchased for 3 and sold for 3 thus paying no tax.

A tax-deferred retirement account is also a tax shelter though not a permanent one. See also abusive tax shelter. One can do this through buying stocks or bonds opening a savings account with your bank a certificate of deposit or even investing in real estate.

448d3 which states that the term tax shelter has the meaning given such term by section 461i3 Sec. In other words you are having to put money into the investment to keep it floating. Tax shelter and tax evasion are totally different concepts and the two must not be confused with one another since the former is a legal procedure while the latter is illegal.

Fundrise - 23 Returns Last Year from Real Estate - Get Started with Just 10.

How The Broad Definition Of Tax Shelter Affects Business Interest Deductions And Cash Method Accounting Under New Tax Law Article Refinancing Mortgage Mortgage Letter Gifts

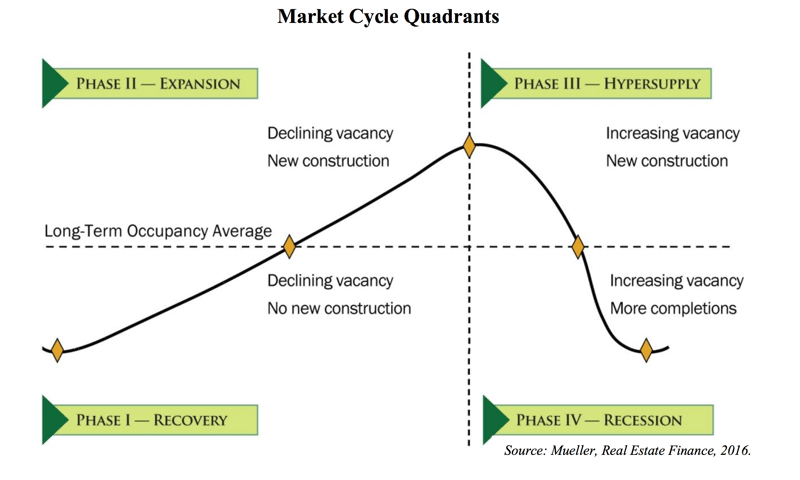

The Four Phases Of The Real Estate Cycle Crowdstreet

Libor Transition Creates Possible Disconnect Exposure How To Be Outgoing Real Estate Tips Newport Beach Homes

Investing In Multifamily Properties The Complete Guide Fortunebuilders

Income Tax Explained Earning I Want To Buy A House Income Tax Income Tax

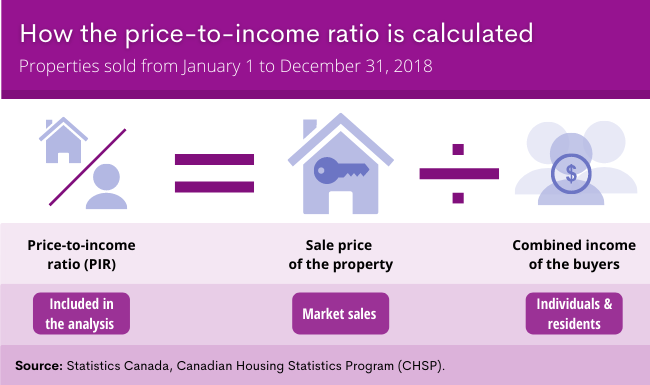

Residential Real Estate Sales In 2018 The Relationship Between House Prices And Incomes

Tax Shelters Definition Types Examples Of Tax Shelter

Real Estate A Safer Investment Option Post Covid Assetz

Property Flipping Tax Implications In Canada Cpa Firm In Toronto

How To Decide If A Property Is A Good Investment The Washington Post

15 Best Real Estate Stocks In Canada 2022 Be A Lazy Landlord

9 Ways To Invest In Real Estate Without Buying Property In 2019

Real Estate Blog Mortgage Rates Today 30 Year Mortgage 10 Year Mortgage

Canadian Real Estate Works In A Cycle Here S Where We Are Better Dwelling

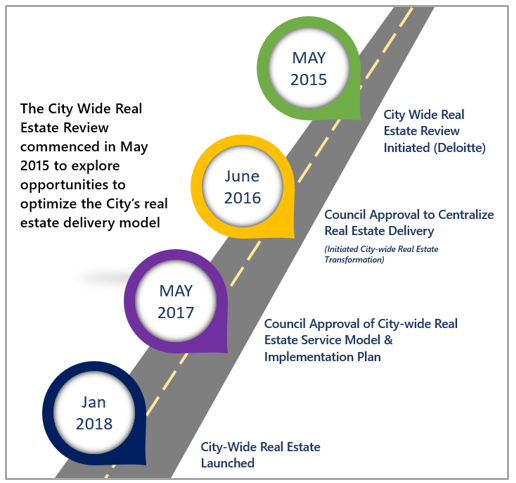

2018 Issues Briefing City Wide Real Estate Transformation City Of Toronto

Invest In Real Estate Real Estate Investment In 2022 Investment Property Investing Real Estate Investing Books